Chino Valley Insights

Your go-to source for local news, events, and information in Chino Valley.

Renters Insurance: The Unsung Hero of Your Apartment

Discover why renters insurance is the vital safety net every apartment dweller needs. Protect your belongings and peace of mind today!

What Is Renters Insurance and Why Do You Need It?

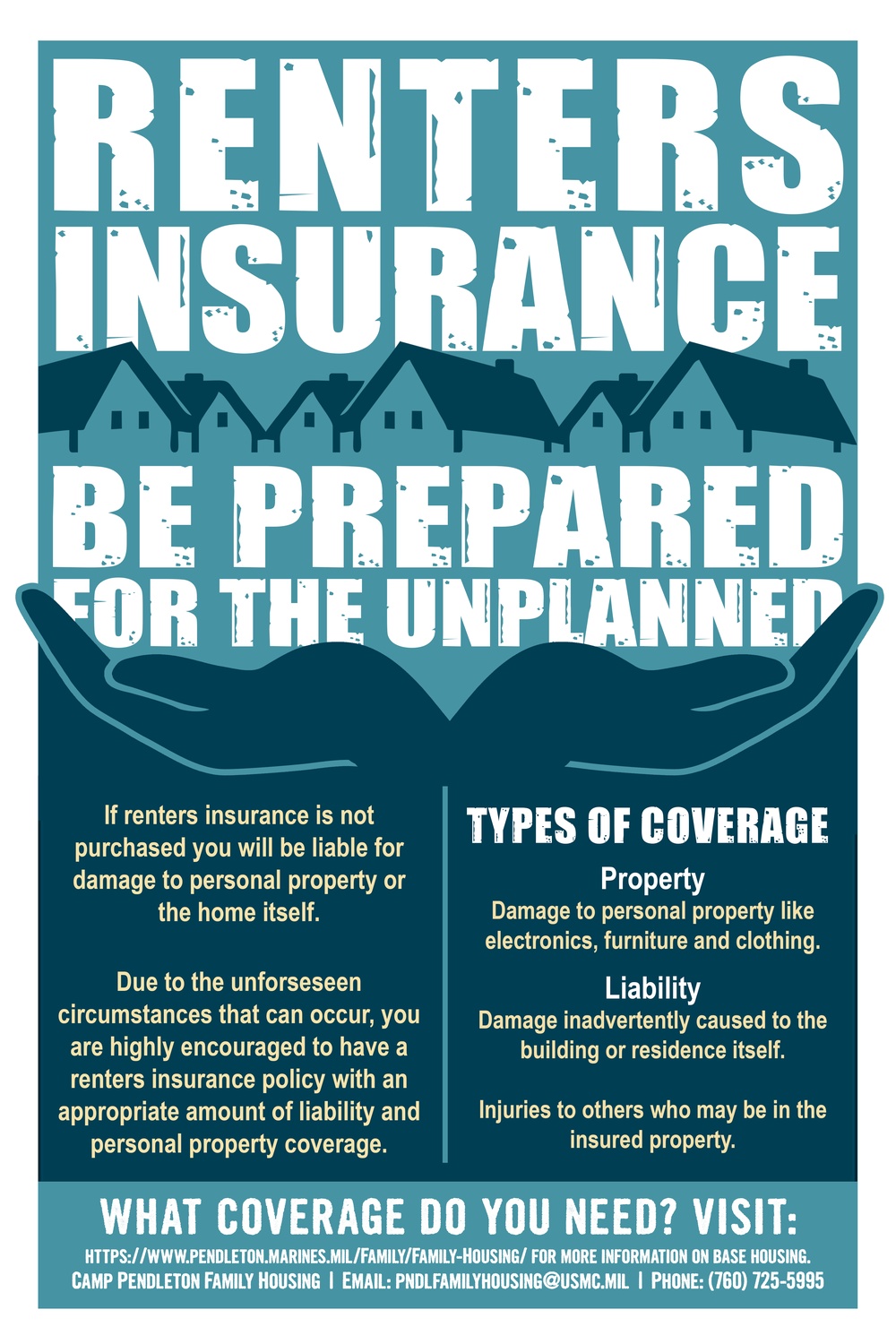

Renters insurance is a type of insurance policy specifically designed to protect individuals who are renting a home, apartment, or any other type of leased dwelling. Unlike homeowners insurance, which covers the structure of a home, renters insurance focuses on the tenant's personal property. This means that if your belongings like furniture, clothing, electronics, or personal items are damaged or stolen, renters insurance can help cover the costs. Additionally, many policies also provide liability coverage, which can protect you in case someone is injured while visiting your rented space.

So why do you need renters insurance? Firstly, it offers peace of mind in uncertain situations. According to statistics, a significant percentage of renters experience theft or property damage due to fire, storms, or other unforeseen events. Having a renters insurance policy can mitigate the financial burden of these incidents, allowing you to replace lost or damaged items without bankrupting yourself. Secondly, many landlords now require tenants to have renters insurance before signing a lease, making it a vital step for anyone looking to secure a rental property.

Top 5 Benefits of Renters Insurance for Apartment Dwellers

When living in an apartment, securing renters insurance can provide a sense of peace and financial protection. One of the primary benefits of having this coverage is protection against personal property loss. If your belongings are damaged due to theft, fire, or other unforeseen events, renters insurance can help you recover the costs of replacing them. This assurance is vital, especially for those living in multi-unit buildings where risks may be higher.

Another significant advantage of obtaining renters insurance is the liability protection it offers. If someone is injured in your apartment or if you accidentally cause damage to others' property, your renters insurance can cover associated legal fees and medical expenses. This means you can have peace of mind knowing that unexpected incidents won't lead to financial ruin. In essence, it's not just about protecting your belongings, but also safeguarding your finances and sense of security.

How to Choose the Right Renters Insurance for Your Needs

Choosing the right renters insurance is crucial for protecting your personal belongings and financial interests. Start by assessing your needs; consider the value of your possessions, any potential liabilities, and the level of coverage you desire. Create an inventory of your items, including furniture, electronics, and clothing, to determine the amount of coverage you'll require. Additionally, it’s important to understand the different types of policies available, such as actual cash value versus replacement cost.

- Actual Cash Value: This covers the current value of your belongings, factoring in depreciation.

- Replacement Cost: This provides coverage for the cost to replace your items without factoring in depreciation.

Once you have a clear understanding of your coverage needs, it’s time to shop around for the best rates. Comparing quotes from different insurance providers can help you find the most affordable policy that meets your requirements. Pay attention to the deductible amounts and exclusions in each policy, as these can significantly impact your out-of-pocket costs during a claim. Finally, consider customer reviews and the insurance company’s reputation for service, which can also influence your satisfaction in the long run.