Chino Valley Insights

Your go-to source for local news, events, and information in Chino Valley.

Insurance Policies: What They Don’t Tell You at Signing

Uncover hidden truths about insurance policies that agents won't reveal. Don't sign without knowing these crucial secrets!

Hidden Clauses: What to Look for in Your Insurance Policy

When reviewing your insurance policy, it's crucial to pay attention to the hidden clauses that can drastically affect your coverage. Many policyholders overlook fine print, not realizing that exclusions can negate claims when you need them the most. For instance, understanding limits on natural disaster coverage or specific conditions that void your policy can save you from significant financial loss. Always request clarification from your agent on any ambiguous language, as clear understanding is key to protecting your interests.

In addition to exclusions, look out for additional fees or diminished benefits that may not be immediately apparent. Some policies include clauses that reduce payout amounts based on the age or condition of the insured items. It’s wise to create a checklist of typical hidden clauses, such as:

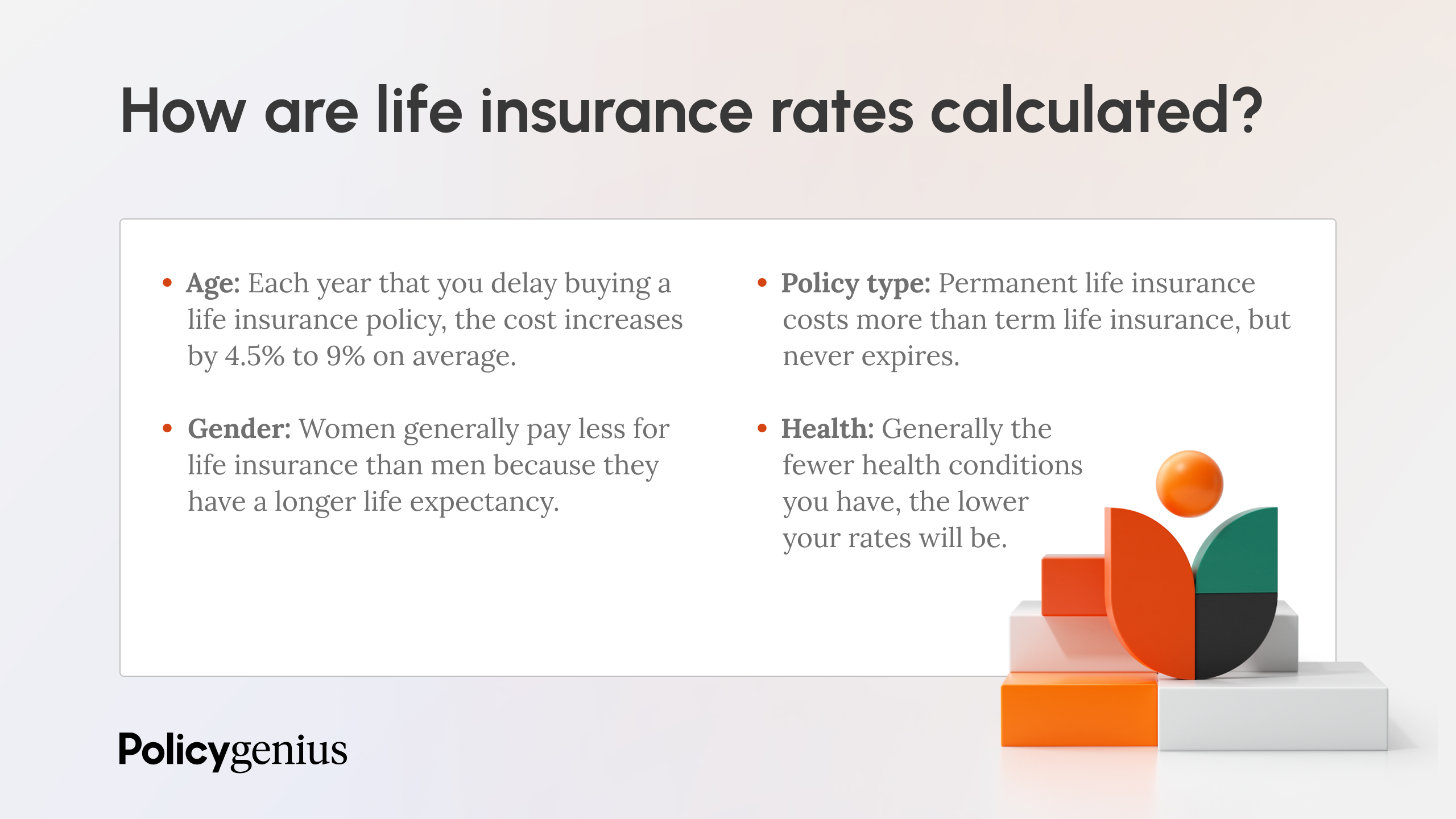

- Rated factors affecting premium costs

- Sub-limits for specific types of property

- Requirements for property maintenance

The Fine Print: Understanding Exclusions in Insurance Policies

When it comes to insurance policies, it is essential to delve into the fine print to understand what is included and, just as importantly, what is excluded. Exclusions can significantly impact the coverage you receive, often leaving policyholders surprised and financially vulnerable when a claim is denied. Common exclusions may include natural disasters, pre-existing conditions, or specific types of damage. By familiarizing yourself with these exclusions, you can make informed decisions and tailor your insurance coverage to your unique needs.

To effectively navigate the complexities of exclusions in insurance policies, consider the following steps:

- Read your policy carefully: Don’t skip over the fine print; take the time to understand each exclusion.

- Ask questions: If something isn’t clear, reach out to your insurance agent for clarification.

- Compare policies: Different providers may have varying exclusions, allowing you to choose a policy that best fits your requirements.

Are You Really Covered? Common Misconceptions About Insurance Policies

Understanding insurance policies can be a daunting task, leading to several common misconceptions that may leave individuals feeling underprepared in times of need. One prevalent myth is that all types of damages are covered under standard policies. In reality, insurance plans often have specific exclusions. For instance, flood damage is typically not included in standard homeowners insurance but may require separate coverage. It's crucial for policyholders to read the fine print and understand what their specific policy entails to ensure they are genuinely covered.

Another significant misconception is that having insurance equates to being fully protected. Many people assume that their policy will cover every type of loss or liability. However, deductibles and coverage limits can significantly impact what an insured individual can claim. For example, if a homeowner has a high deductible, they might find themselves with out-of-pocket expenses that exceed their budget in a time of crisis. To avoid unpleasant surprises, it's essential to review and discuss your policy details with an insurance agent regularly.