Chino Valley Insights

Your go-to source for local news, events, and information in Chino Valley.

Health Insurance: Your Wallet's Best Friend or Worst Nightmare?

Discover if health insurance is a financial lifesaver or a costly mistake. Unravel the true impact on your wallet today!

Understanding the True Cost of Health Insurance: Savings vs. Expenditures

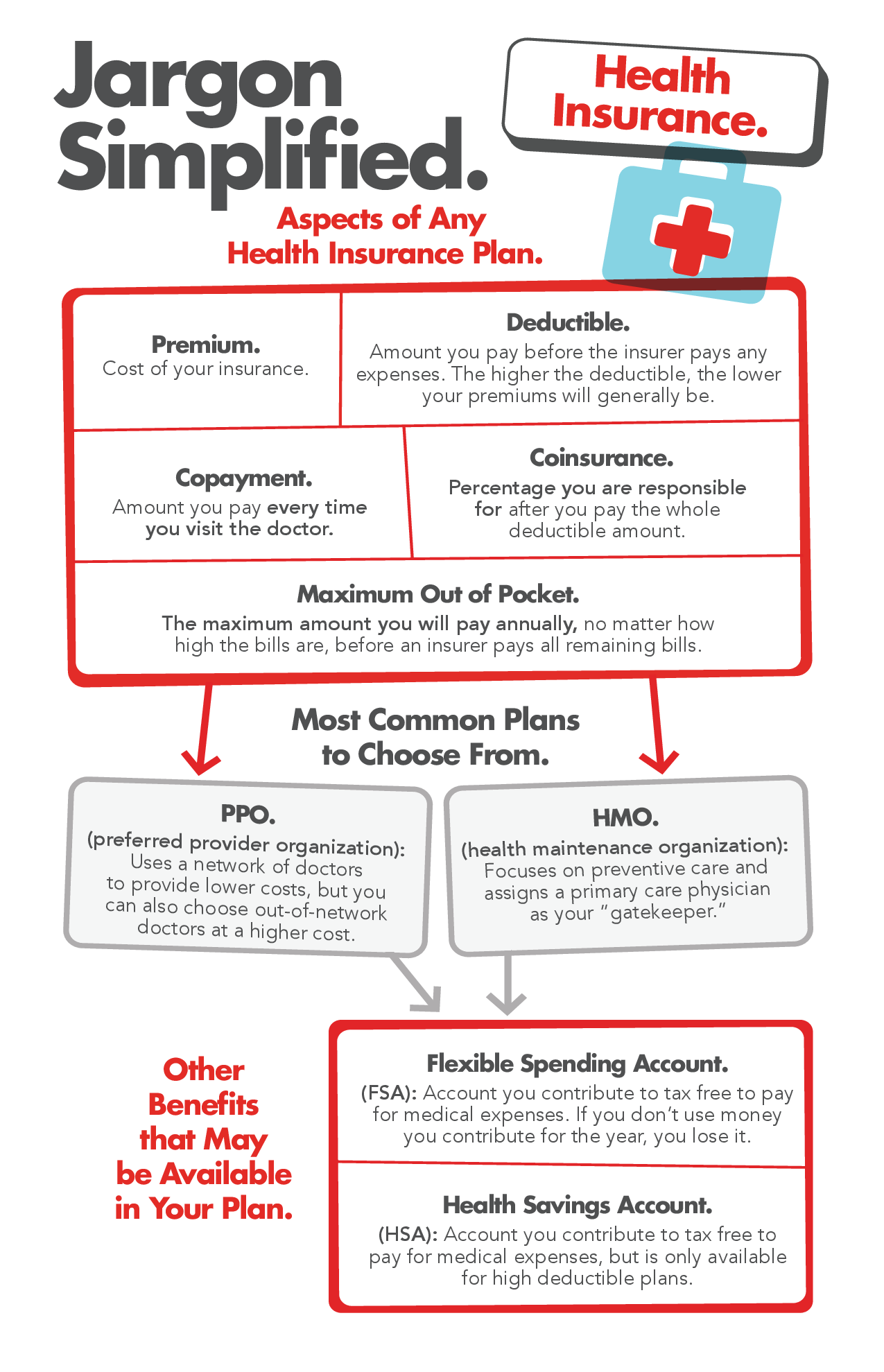

Understanding the true cost of health insurance goes beyond just the monthly premiums. While lower premiums might seem appealing, they often lead to higher out-of-pocket expenses in the form of deductibles, copayments, and coinsurance. Savings can be misleading if you're not considering the full picture, which includes potential costs for services that may not be fully covered by your plan. It’s essential to analyze not just what you pay monthly, but also the expenditures you might face when you actually need healthcare.

When evaluating health insurance options, it's crucial to consider both savings and expenditures. For example, a plan with a low premium might save you money upfront but could be accompanied by a high deductible, meaning you'll pay more when seeking care. On the other hand, a plan with higher premiums may offer better coverage and lower out-of-pocket costs during medical visits. Therefore, taking the time to calculate your estimated healthcare usage and associated costs can provide a clearer picture of your true cost of health insurance, ensuring you choose the plan that best suits your financial and health needs.

Is Health Insurance Worth It? Weighing the Pros and Cons

When considering whether health insurance is worth it, it's essential to weigh the benefits it provides against the costs involved. On one hand, having health insurance can protect you from exorbitant medical expenses in case of an emergency or unexpected health issues. For example, a single hospital visit can result in thousands of dollars in bills. Health insurance often covers a variety of services, including routine doctor visits, preventive care, and specialist consultations, which can help ensure that your health is monitored and maintained without a crippling financial burden.

On the flip side, the monthly premiums and out-of-pocket expenses associated with health insurance can be significant, leading some individuals to question its overall value. Many people find themselves paying for coverage that they seldom use, leading to feelings of frustration. Additionally, with rising deductibles and copays, some might argue that the out-of-pocket costs can overshadow the benefits. To make an informed decision, consider factors such as your health status, the frequency of medical services you require, and whether you have a reliable emergency fund to cover unexpected expenses.

Top 5 Common Misconceptions About Health Insurance You Need to Know

Health insurance can often be misunderstood, leading to several misconceptions that can affect your decisions regarding coverage. One of the most common myths is that if you're healthy, you don't need insurance. In reality, health emergencies can happen unexpectedly, regardless of your current health status. Having insurance ensures that you're financially protected during such times. Additionally, many believe that all health insurance plans cover the same services, but this is not true. Different plans vary significantly in terms of coverage options, deductibles, and out-of-pocket expenses, making it essential to understand what each plan offers before making a decision.

Another prevalent misconception is that obtaining health insurance is too expensive and not worth the investment. While premiums can vary, there are numerous options available, including government programs and employer-sponsored plans that can make coverage more affordable than you think. Furthermore, some people assume that preventive care is not included in their insurance benefits. However, most plans cover essential preventive services like vaccinations and screenings at no cost to encourage individuals to seek necessary care before more serious health issues arise. Understanding these aspects can help dispel the myths and empower you to make informed choices about your health insurance.