Chino Valley Insights

Your go-to source for local news, events, and information in Chino Valley.

Whole Life Insurance: Your Safety Net or Just a Safety Rope?

Discover whether whole life insurance is your ultimate safety net or just a temporary lifeline. Uncover the truth behind your policy!

Understanding Whole Life Insurance: Is It the Right Safety Net for You?

Whole life insurance is a type of permanent life insurance that provides coverage for the entirety of your life, as long as premiums are paid. One of the main advantages of whole life insurance is its dual benefit: not only does it provide a death benefit to your beneficiaries, but it also accumulates cash value over time. This cash value grows at a guaranteed rate, allowing policyholders to borrow against it if needed. Understanding these features is crucial in evaluating whether this form of insurance can serve as an ideal safety net for your financial future.

When considering if whole life insurance is the right choice for you, it's essential to assess your financial goals and obligations. Ask yourself the following questions:

- Do you have dependents who rely on your income?

- Are you looking for a long-term investment that provides growth potential?

- Can you afford the higher premiums associated with whole life policies compared to term life?

Whole Life Insurance vs. Term Life: Which Provides a Stronger Safety Rope?

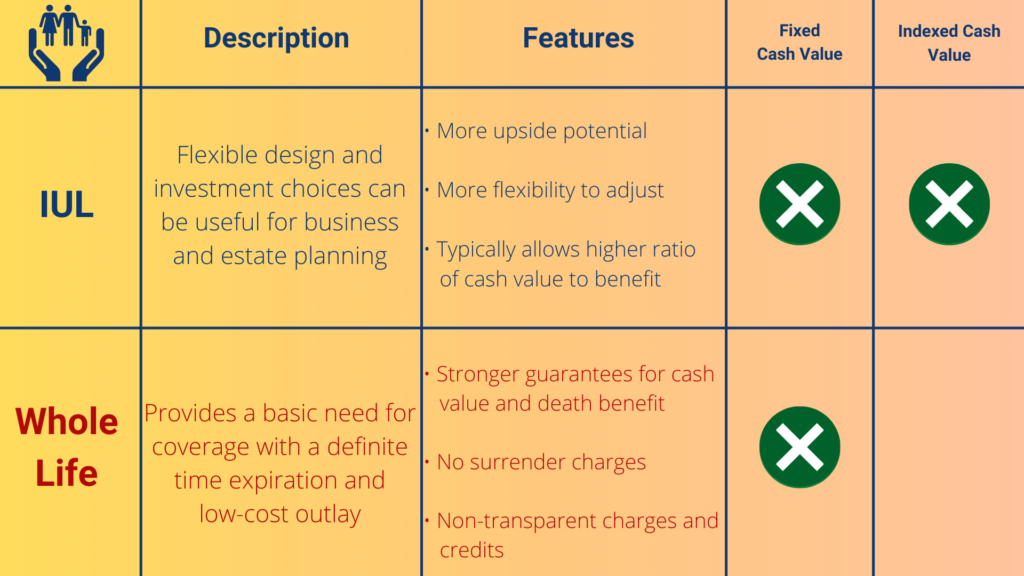

Whole Life Insurance and Term Life Insurance serve the primary purpose of providing financial security, but they do so in significantly different ways. With Whole Life Insurance, you are investing in a policy that lasts your entire lifetime, combining a death benefit with a cash value component that grows over time. This makes it an appealing choice for individuals seeking a long-term safety net. In contrast, Term Life Insurance is designed to offer coverage for a specific period, such as 10, 20, or 30 years, making it a more cost-effective option for those who want substantial coverage without the higher premiums of whole life policies. Depending on your financial goals, either option can provide a crucial safety rope to protect your loved ones in the event of your untimely passing.

When comparing Whole Life and Term Life, it's important to consider your unique needs and financial situation. Whole Life Insurance can be viewed as an investment due to its cash value component, which allows policyholders to borrow against it or withdraw from it. This can provide a more flexible safety net, particularly for long-term planning. On the other hand, Term Life Insurance may be a better fit for younger families who need substantial coverage at a lower premium to guard against significant financial setbacks during critical years. Ultimately, the decision should be guided by evaluating your current needs alongside your future financial goals, as both policies offer distinct advantages in providing a strong safety rope for your loved ones.

Debunking Myths: What You Really Need to Know About Whole Life Insurance

Whole life insurance often carries a cloud of misconceptions that can confuse potential policyholders. Many people believe that it is solely a savings vehicle due to its cash value component, but this is only part of the picture. Whole life insurance is primarily a form of permanent life insurance that provides lifelong coverage, as long as premiums are paid consistently. Unlike term life, which offers coverage for a specific period, whole life insurance guarantees a death benefit to beneficiaries, making it a valuable financial planning tool for those seeking long-term security.

Another common myth is that whole life insurance is too expensive for the average person. While it's true that the premiums are generally higher than those for term policies, it is essential to consider the benefits it provides over time. Whole life insurance accumulates cash value that can be borrowed against or withdrawn, offering policyholders financial flexibility. Additionally, the premiums remain level throughout the policyholder’s life, making it a predictable expense. By debunking these myths, individuals can make informed decisions about their financial futures and find the right insurance coverage that meets their needs.